If you are planning to do an internship or have a job in Spain, you will need a numéro de seguridad social or a social security number. But you must be asking, what is this number used for and how can I get it? Well, you are in the right place. Keep reading to find out everything you need to know about the Spanish social security number.

What is a social security number?

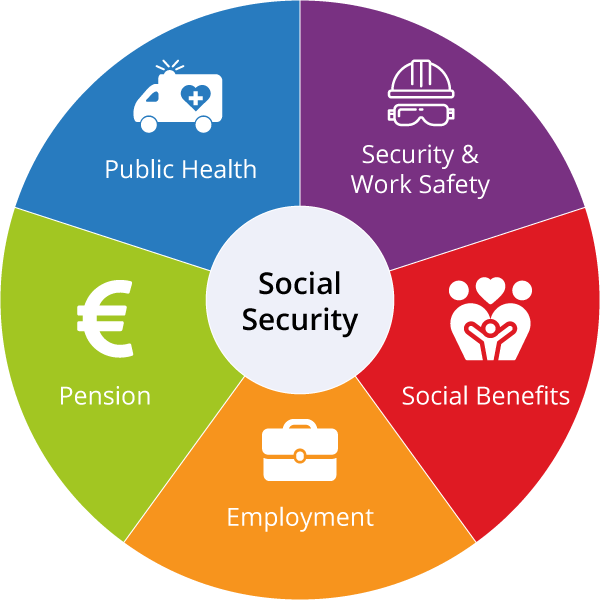

Let’s begin with the whole social security system.

A social security system is where a government guarantees economic security to its citizens and residents. Its objective is to provice protection against situations of illness, disability, unemployment, old age, accidents at work, maternity or loss of the family’s means of support.

A social security number (SSN) is a personal and identifiable dedicated number to you as an employee and tax payer for life. It is the number that connects you to the entire system.

Any citizen or worked whether employed by another person or self-employed who does not have a SSN may request one.

You will need to give this number to your employer and you will need it if you are planning to work as an autónomo/a or a freelancer. It is necessary to have it especially if you need to access the public health care and security. The government and employers use this number to track your pension, welfare (if you are eligible), and other labor activities such as paternal/maternal leave.

Healthcare is one of the biggest advantages of being in the social security system, and your employer covers the necessary fee for your basic care. In most regions, general doctor visits and emergency care are free at public clinics and hospitals.

Dental cares and surgeries are usually not covered by the system and you may have to pay out of your pocket (unless you have a healthcare plan that covers that).

If you are an international student in Spain, check out our Sanitas International Student Health Insurance.

Who can apply for a Spanish social security number?

Anyone who legally resides in the Spanish territories can apply as long as you belong to one of the following categories:

- Employees working for a company or another person

- Self-employed workers (autónomo)

- Working partners in associated work co-operatives

- Students who are doing a professional internship and are on the company’s payroll

- Civil Servants or Military Personnel.

How can I get a Spanish social security number?

The process is relatively easy and shouldn’t take more than half an hour (even though legally they say that it may take up to 45 days but it almost never takes that long). You need to have the necessary documents (see below) with you and present them if asked.

Where can I get a Spanish social security number?

You can go to any social security office called Tesorería de la Seguridad Social (Treasury of Social Security) in your area, get a number and wait for your turn to hand them your documents. Usually an appointment is not needed.

Post-COVID-19: due to the COVID-19 situation, the government has moved a lot of the activities and requirements online which has made the process more complicated than before. For all the information, you need to visit the official website of the Spanish Social Security System (the official website has very limited information available in English. You must know Spanish to be able to work things out).

Here are some of the physical locations in Barcelona:

- c/ Sant Antoni Maria Claret, 5-11. 08037. BARCELONA

- c/ Arc del Teatre, 63-65, planta primera. 08001. BARCELONA

- Arc del Teatre, 63-65, planta baja. 08001. BARCELONA

- c/ Reus, 29. 08022. BARCELONA

- c/ Marie Curie, 22. 08042. BARCELONA

- c/ Concepción Arenal, 299. 08030. BARCELONA

- c/ Lope de Vega, 132. 08005. BARCELONA

For the complete list, go here.

Remember that in 99% of cases, the civil servants will not speak a word of English so either you should go with a Spanish speaker or learn a couple of phrases to say:

Useful phrases:

- Necesito un numero de seguridad social – I need a social security number

- Tengo un convenio de práctica – I have the internship paper

What documents do I need?

- Passport or a valid NIE (an expired NIE will not be accepted*)

- Application form TA1 (click here to download the TA1 form) You can do it electronically and then print and sign it or request one in the office. Scroll down for help on how to fill out the application form)

- Internship paper signed by both the company and the school if you are here on a student visa and are interested in doing an internship at the same time

- Empadronamiento (optional; if you don’t know what empadronamiento is, read our blog What is Empadronamiento and How to Get a Padrón)

- Any other documents that would support your case (e.g. house contract, job offer, etc)

* If your NIE has expired, you must show the Social Security Office a document that proves you are in the process of renewing your NIE.

Filling out the form TA1

On the second page, there are 2 sections you will have to fill out. We recommend filling it out using ALL CAPS.

Section 1: DATOS DEL SOLICITATE (Applicant’s information)

- 1.1 PRIMER APELLIDO – First last name

- SEGUNDO APELLIDO – Second last name (if applicable)

- NOMBRE – First name

- 1.2 SEXO – Sex: M (Masculino) or F (Feminino)

- 1.3 TIPO DE DOCUMENTO IDENTIFICATIVO (Marque con una“X”) – Identity Card (identify with X)

- TARJETA DE EXTRANJERO: Mark this if you have a NIE.

- PASAPORTE: Mark this if you do not have a NIE

- 1.4 Nº DE DOCUMENTO IDENTIFICATIVO – Enter your NIE or passport number here.

- 1.5 NÚMERO DE SEGURIDAD SOCIAL: Fill this out only if you already have a SS number. Leave blank if you applying to get one.

- FECHA DE NACIMIENTO – Birth date

- Día – Day (e.g. 29)

- Mes – Month (e.g. 12)

- Año – Year (e.g. 1985)

- NOMBRE DEL PADRE – Father’s name

- NOMBRE DE LA MADRE – Mother’s name

- LUGAR O MUNICIPIO DE NACIMIENTO – Birthplace (e.g. Los Angeles)

- PROVINCIA DE NACIMIENTO – Province or state of birth (e.g. California)

- PAÍS DE NACIMIENTO – Country (e.g. BRAZIL)

- 1.6 GRADO DE DISCAPACIDAD – Disability: leave blank if you have no disabilities

- NACIONALIDAD – Nationality

- 1.8 DOMICILIO

- TIPO DE VÍA – What kind of place you live in (e.g. street: Calle / avenue: Avinguda)

- NOMBRE DE LA VÍA PÚBLICA – Street name (e.g. Diagonal)

- MUNICIPIO – Municipality: If you live in Barcelona, write Barcelona

- PROVINCIA – Province: Barcelona or Madrid

- 1.9 DATOS TELEMÁTICOS – Telemetric datas

- CORREO ELECTRÓNICO – Email address

- ACEPTO ENVÍO COMUNICACIONES INFORMATIVAS DE LA SEGURIDAD SOCIAL – Do you wish to receival informational materials from the Social Security system?

- TELÉFONO MÓVIL – Mobile number

Then scroll down to the bottom left of the page:

- Lugar – Place: Write the city where you live (Barcelona, Madrid, …)

- Fecha – Date: Write the date when you will be submitting your application

- Firma – Signature: Digitally or manually sign sign the paper and take a copy of it with you

Now take all the documents to a social security office and submit them. You should have your SSN in less than an hour.

We look forward to hearing your feedback. Let us know in the comments sections below your questions and concerns.

Are you a student looking for affordable student insurance?

We work with Sanitas and offer the best and most affordable health insurance package to all international stuents.

Need a health insurance for your Spanish student visa? Or to renew your NIE?

Just fill out our Health Insurance form and have your insurance ready in a few days.

How useful was this post?

Click on a star to rate it!

Average rating 4.9 / 5. Vote count: 367

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Hii, I’m doing an unpaid internship here and I have got TIE and Nie and now I want to work part-time at the same time. Do I need this number? Thank you!

Hi Meri. If you are going to be on the payroll, yes, you do need this number for tax purposes. Thanks

How much does it cost the social security number?

Hi Ralf. It does not cost anything to get a social security number. Thanks

Hey, thank you very much for the article. I am doing an internship here in Barcelona since september and it’s until the 15th of december. Will they still give me the social number even for this short period? I am also applying for universities here but I dont have the response if I am accepted yet.

thanks!

Hi Fahrina. You need a SSN only if you pay taxes. If you do not pay taxes or not getting paid, you do not need a SSN. Thanks

Thank you for the post! it is very informative. I am going to stay in Spain for less then 6 months (5,5), thus I won’t need empadroniamento. Can I still apply for social number? Thank you

Hi. Yes, if it’s less than 6 months, you don’t need to do it. You can apply for the SSN if you have any paid internship/job offer. Thanks

Hi, do i need to pay for the SSN? If yes, how much?

Thanks.

Hi Joey. No, you do not need to pay for the SSN. Thanks